Expert First Time Buyer Mortgage Broker Services

Buying your first home can be overwhelming. As a first time buyer—someone who has never owned a property—you face many mortgage options, legal requirements, and saving challenges. Managing your money is key, including knowing how much you need for your deposit and other costs. Most buyers will encounter additional expenses such as fees and deposits when purchasing their first home. You might also consider joint mortgages or involving a family member to help with the deposit. A joint mortgage can help you to be able to borrow a larger amount, making it easier to purchase a home.

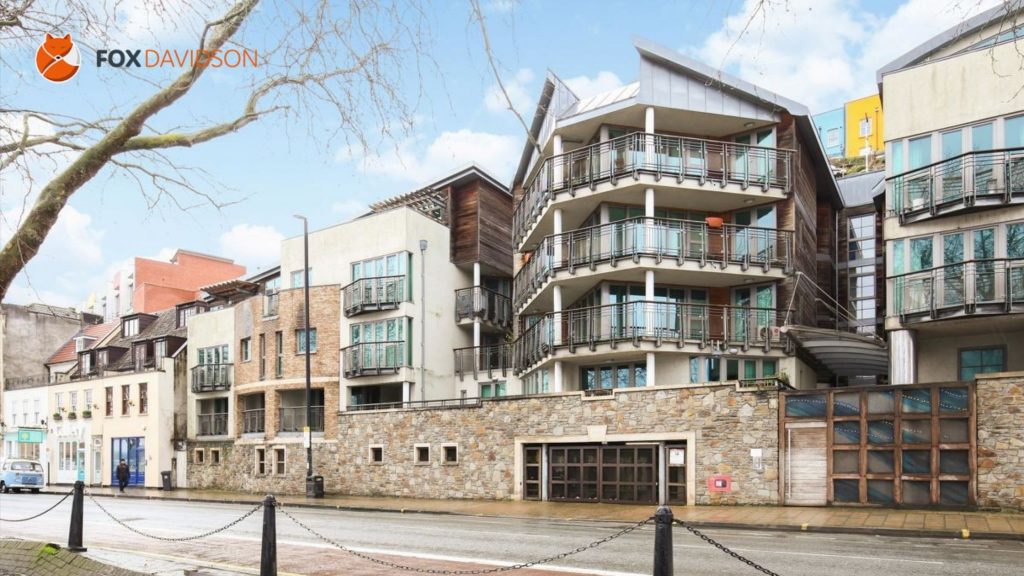

At Fox Davidson, a dedicated first time buyer mortgage broker, we simplify the home buying journey so you can focus on getting your keys faster.

Call or email the team to discuss how much you can borrow today!

Why Choose Fox Davidson as Your First Time Buyer Mortgage Broker

Fox Davidson helps you:

- Save Money – We find competitive mortgage rates and exclusive first time buyer mortgages that could save you thousands over your mortgage term.

- Access Special Schemes – We connect you with schemes such as low deposit schemes and enhanced income multiples.

- Get Faster Approval – We prepare your application and secure your Agreement in Principle quickly with a soft credit check.

- Avoid Legal Delays – We guide you through conveyancing, surveys, and coordinate your completion date.

- Maximise Borrowing Power – We help you understand how much you can borrow and find the best loan for your needs, while also making sure you are aware of the risks associated with loans, such as payment difficulties or changes in property value.

- Choose the Right Mortgage Term – We advise on terms that fit your budget and goals.

Our qualified advisers support you every step of the way, making your journey smoother.

How Fox Davidson’s Process Works

Step 1: Financial Health Check We assess your income, expenses, debts, and credit history. We help calculate your deposit, potential mortgage payment, and budget for your property search, including legal fees, valuation fees, and other costs.

Step 2: Mortgage Market Analysis We compare rates from across the market. Calculate all costs including lender fees, cash back and valuation fees. We present the most cost effective mortgage solution for you and have the loan agreed in principle. With your budget and Agreement in Principle, you can start house hunting.

Step 3: Application to Completion We handle your full mortgage application and coordinate surveys and the legal process. You can also apply online for your mortgage, making the process more convenient. Managing your mortgage online allows you to view estimated loan amounts, interest rates, and payment details easily.

Understanding Conveyancing and Legal Processes

Conveyancing is the legal transfer of property ownership. Conveyancing involves reviewing the characteristics and valuation of properties to ensure a smooth transaction. A solicitor or specialist conveyancer handles this, reviewing contracts and negotiating with the seller. Choosing the right professional familiar with first time buyer mortgages and the local market is important.

Budget for legal fees, valuation fees, and buildings insurance—these add to your costs. Use an online mortgage calculator or speak with a mortgage adviser to plan accordingly. Don’t forget about stamp duty which may apply depending on your property’s price and location. These taxes are calculated based on the property’s value, so understanding the property’s worth is essential. Many first time buyers qualify for relief or exemptions.

Your solicitor will keep you updated through legal searches, contract preparation, and negotiations. Once complete, you get the keys to your new home.

Key Considerations for First Time Buyers

Saving for Your Deposit and Other Costs

One of the biggest hurdles for first time buyers is saving enough for a deposit. Typically, a deposit is at least 5% of the purchase price of the property, but putting down a larger deposit can help reduce your interest rate and monthly payments. Aside from the deposit, you need to budget for legal fees, valuation fees, buildings insurance, and potential moving costs.

Understanding Mortgage Types

There are various types of mortgages available, including repayment mortgages and interest only mortgages. Repayment mortgages involve paying both the interest and part of the loan amount each month, so you gradually own more of your home. With an interest only mortgage you only pay the interest. These are reserved for clients with larger incomes and low loan to values. Your mortgage adviser can help you choose the best option based on your financial situation.

Checking Your Credit File

Before you apply for a mortgage, it’s important to check your credit file. Lenders use this to assess your creditworthiness. If there are any errors or negative marks, addressing them early can improve your chances of approval and secure better rates.

Government Backed Schemes and First Time Buyer Schemes

Many first time buyers benefit from government backed schemes designed to help you get on the property ladder sooner. These include shared equity schemes, Help to Buy, and other incentives that may reduce your deposit requirements or offer more favourable terms. Fox Davidson can help you identify and apply for these schemes.

The Importance of Getting a Mortgage Offer

An Agreement in Principle gives you a rough idea of how much you could borrow, but it is not a guarantee. After you make a full mortgage application, your lender will issue a mortgage offer if approved. This offer details the terms of the loan you are committing to repaying.

Dealing with Estate Agents and House Hunting

Once you have your Agreement in Principle, you can start house hunting. Working with experienced estate agents can help you find the right property. Remember to consider the location, condition, and whether the property meets your needs as a main residence or investment.

What Happens If Things Go Wrong?

It’s important to be aware of the risks. If you can’t keep up repayments on your mortgage, your home may be repossessed. Always budget carefully and consider what might happen if your circumstances change, such as losing your job or facing unexpected expenses. Fox Davidson can help you plan for these possibilities.

Mortgage Rates and Repayments

Getting your head around mortgage rates and repayments is crucial if you’re looking to get on the property ladder for the first time. The rate you manage to secure will directly hit your monthly payments and what you’ll end up paying over the full term. We’re seeing mortgage rates vary quite dramatically between lenders right now, and it all comes down to your credit history, how much deposit you can scrape together, which type of mortgage you go for, and how long you want to tie yourself in for.

Helpful Advice

- We would advise getting familiar with an online mortgage calculator to get a rough idea of borrowing capacity and what those monthly payments might look like. This tool lets first time buyers play around with different interest rates, loan amounts, and terms – it’s brilliant for planning your budget and seeing how a rate change or bigger deposit could impact your finances before you dive into an application. It’s worth spending time on this.

- Your credit file is absolutely key to the mortgage rates you’ll be offered, and lenders will run those checks as part of your application. A solid credit history opens doors to more competitive rates and better terms – that’s just how the game works. If your credit file isn’t perfect, don’t panic. There are still first time buyer mortgages out there, but you’re likely looking at higher interest rates or needing a chunkier deposit.

- First time buyers should definitely explore government backed schemes and first time buyer programmes – they can genuinely help you get on the ladder sooner than you might think. These schemes often offer lower interest rates, reduced deposit requirements, or other benefits that make your first home more affordable. However, and this is important, always scrutinise those mortgage terms carefully and factor in all the other costs – legal fees, valuation fees, buildings insurance, stamp duty. They add up faster than you’d expect.

- It’s worth remembering that your monthly payments will typically include both interest and capital but in the early years most of your monthly payment will go towards the interest.

Moving Forward: Your Dream Home Awaits

Buying your first home is a major milestone. With the right advice and support from Fox Davidson, you can navigate the complexities of the mortgage process with confidence. Whether you’re self employed, newly qualified or just started a new job, we tailor our services to your unique needs.

Ready to take the next step? Contact Fox Davidson today for personalised, expert first time buyer mortgage advice and start your journey to owning your own home.

📞 Call for immediate expert advice

📧 Email with an outline of your requirements

Fox Davidson first time buyer mortgage broker in the UK. Trusted by thousands of first time buyers to make homeownership simple and affordable since 2013.